Improving the Mortgage Loan Processing Gemba

There is a beautiful Japanese word, Gemba, which means “the place where things happen”.

One of my favorite Lean Thinking technique is Gemba Walks, which is the practice to go seeing how things are getting done. As described in a book by Jim Womack, who is widely considered the father of the Lean Management movement, the Gemba is the place where work takes place, and where value is created.

The Mortgage Industry, in the last years has invested almost exclusively in the front end with the aim to improve CX but leaving the back end behind which is where efficiency and processing happen, lenders are falling short with value creation, which resolves into poor CX.

Watching Mortgage Loan processing from a different perspective, is the opportunity for mortgage business leaders to re-think how they go about creating value, delivering service, and fulfilling purpose.

Align Journey and Process

The way in which we are evaluating Mortgage Loan Processing is from the business process perspective. We are focus on all those resources such as loan officers, underwriters, mortgage advisors, and customer service representatives, who are the actual processors behind the scenes. Also, we are considering all the other resources involved in the value creation that are external to the mortgage organization that must be included in this scenario because they support the customer journey, so cannot be siloed outside the process mapping.

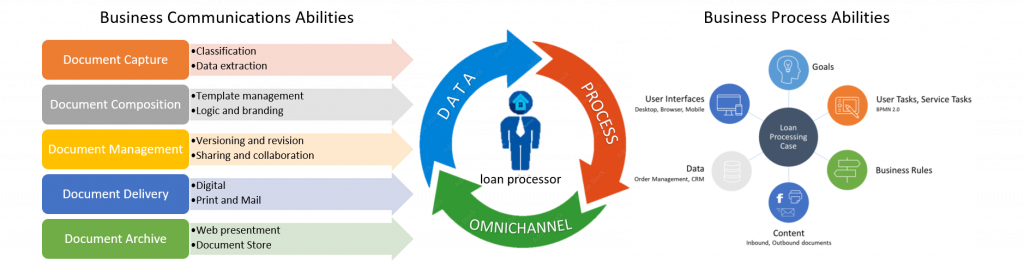

As a software company, Papyrus is committed to support and facilitate all the interactions, in & out, between a Borrower and the Mortgage organization, which means putting at the loan processor’s fingertips all the tools needed to manage efficiently, safely, and transparently the Customer Lifecycle.

Avoiding duplication of effort collecting and processing data and documents will improve CX, and will improve the organization confidence in the process as well as in the technology. Being aware at which stage of the process a customer is means providing the best experience possible. So, giving full access to information, documents, and process stages, making all the resources involved able to collaborate and to sharing knowledge, should be the main goal to be pursued by Mortgage Business Leaders.

In other words, we believe that improving the mortgage Gemba will create more value with less waste, variation, and overburden. While the front-end is characterized by a growing digitalization, the back end is still heavily based on human intervention to gather information, manually transfer them into applications and forms, comparing that information with third-party data source.

Communications, inbound and outbound, are key to improve CX, so supporting and facilitating the communication process will align Journey and Process.

Papyrus Process and Communications Hub has been designed to respond to these needs, it bridges front-end and back end of the mortgage loan processing empowering loan processors who will create value for the customers while minimizing waste and risks for the mortgage organizations.

Benefits

- Full understanding and visibility of the end-to-end process

- Transparency

- Easy access to data and documents

- Higher productivity in less time

- Reduced elapsed time from Request To Response

- Improved Customer Experience

- Lower complexity due to the Compliance and Regulatory Requirements

- Scalability

As mentioned multiple times in this article and also in other previous publications, this is not just a matter of buying the right software. When it comes to process improvement and process automation is more the ability to blend people, process, and technology in a Center of Excellence (COE) to manage and develop the mortgage organization automation platform, cultivate employee skills, and identify automation best practices. So it is mid-set, is the understanding of the E2E Business Value Stream, is the ability to support the complete journey.

This is what Papyrus can do for you and with you in the continuous value creation effort.

So, let’s go taking a Gemba Walk together!

Business Development Senior Advisor at Papyrus Software

Southlake, TX