Papyrus Empowers Unobank's High-Growth Strategy in Asia

Business Results

- Reliability and scalability meeting the UNObank's high growth demands

- Fast time-to-market

- Putting business users in control of the communication

- Seamless customer communication experience

- Enhanced customer loyalty and satisfaction (CX)

Functional Requirements

- Quickly start from scratch

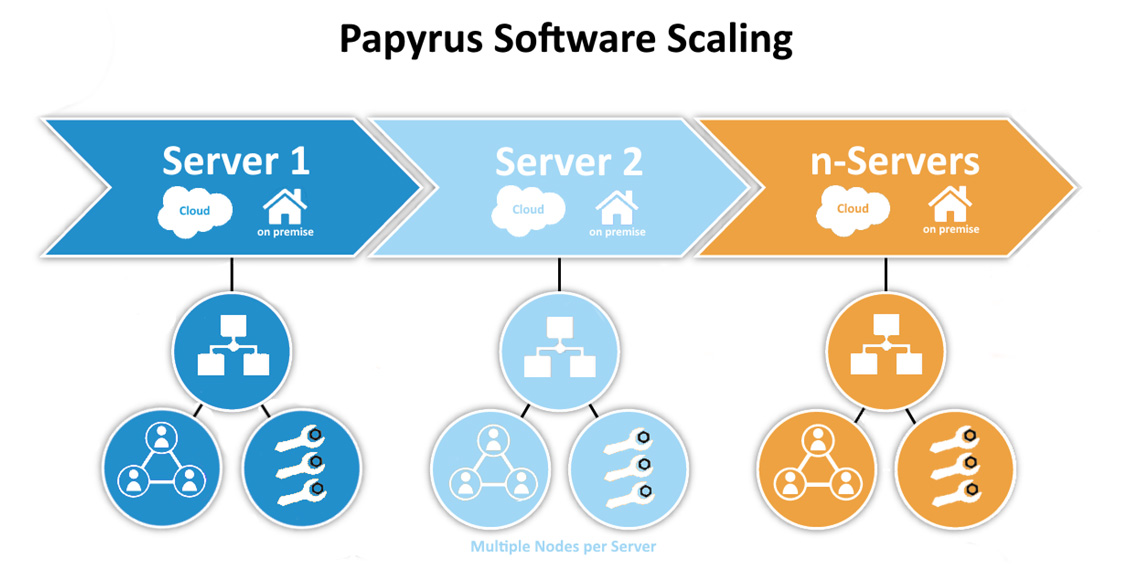

- Rapidly scale the technology infrastructure and operations

- Integrate with the bank's existing cloud core system and other cloud-based software

- Efficiency and scalability of customer communication and document processes

- Provision of innovative and customer-centric solutions

- Delivery of a best-of-a-kind customer experience

- Support of the company's growth trajectory

Papyrus Products at UNOBank

- Papyrus WebRepository

- Papyrus WebServer/HTTPs

- Papyrus Adapter/REST

- Papyrus Designer Package

- Papyrus Business Designer

- Papyrus DocEXEC/Windows

- Papyrus DocEXEC/HTML feature

- Papyrus DocEXEC/PDF feature

- Papyrus Client/Desktop

Snapshot

- Organization: UNOBank

- Business Challenge: Securing the rapidly scaling technology infrastructure and operations to meet the growing demand

- Goals: Fast time-to-market, avoiding costly development of a custom system by leveraging a ready-to-use standard software platform and all the advantages that come with it

- Integration: Cloud banking platform Mambu and the rest of the UNObank's all-cloud, full stack digital bank infrastructure.

- Solution: Papyrus Customer Communication

The Background

Southeast Asia's fintech industry is fiercely competitive, driven by a digitally savvy audience of over 655 million people. Digital banking platforms have revolutionized the way customers manage their finances, providing convenience and security. The region's strong economy and income growth have further fuelled the fintech revolution, with customers demanding innovative solutions to access financial services. Southeast Asia's fintech industry is a testament to the region's digital transformation and is set to shape the future of finance.

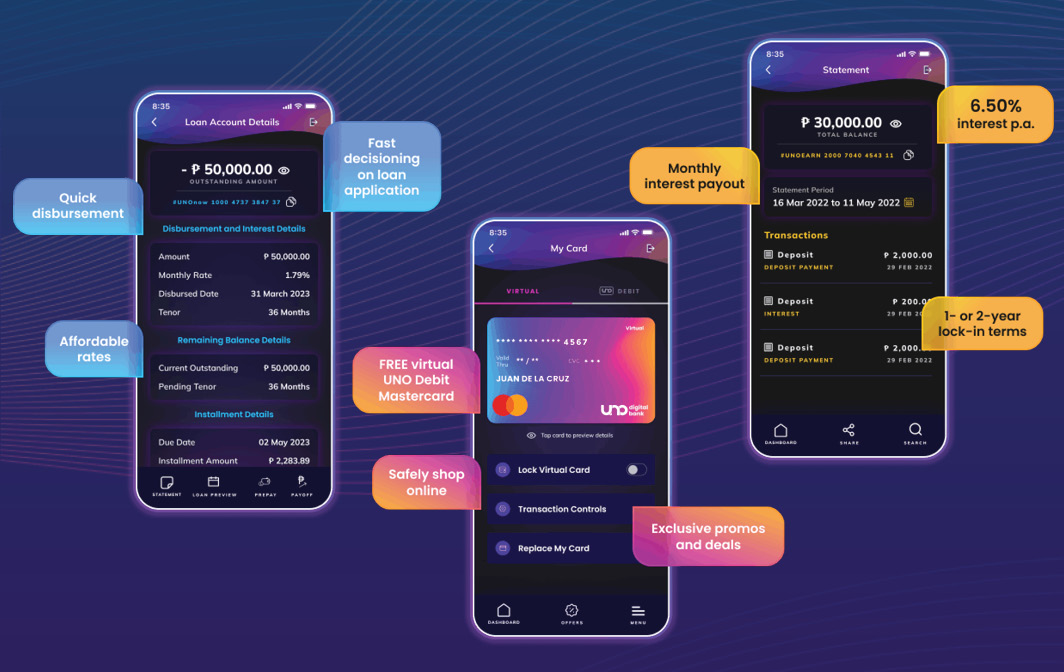

The Company

UNObank is a regional neobank offering next-generation cloud solutions that cater to the banking needs of the ASEAN region, including the Philippines. With a population of over 100 million people, the Philippines is a country with a huge demand for digital banking services. UNObank recognizes this need and aims to provide innovative banking solutions to the country's young, tech-savvy, and growing population. The country has witnessed a rapid economic growth in recent years, and UNObank is committed to using technology to shape the future of banking and improve the banking experience for its customers.

The Challenge

As a fast-growing fintech company, UNObank's main challenge was securing and maintaining the rapidly scaling technology infrastructure and operations to meet the fast growing demand. With a focus on providing innovative and customer-centric solutions, the bank had to ensure that its customer communication and document processes are scalable to support its growth trajectory and deliver a seamless banking experience to its customers.

The Solution

UNObank was looking for an efficient way to quickly start from scratch and kick off their customer communication and document creation, while at the same time ensuring high levels of scalability. With Papyrus Software's extensive experience in providing digital customer communication, the bank decided to leverage the proven technology instead of developing a custom solution, and quickly provide a range of fully digital banking services and products to its customers.

Due to the highly configurable architecture and the BusinessFirst™ approach of the Papyrus platform, UNObank was able to deliver the solution and ensure a seamless adoption process for business users and customers in a very short time. The new communication solution was tailored to the UNObank's specific requirements from day one, while making sure it is designed as a 'fit-for-future' solution to easily adapt and scale with the company's business.

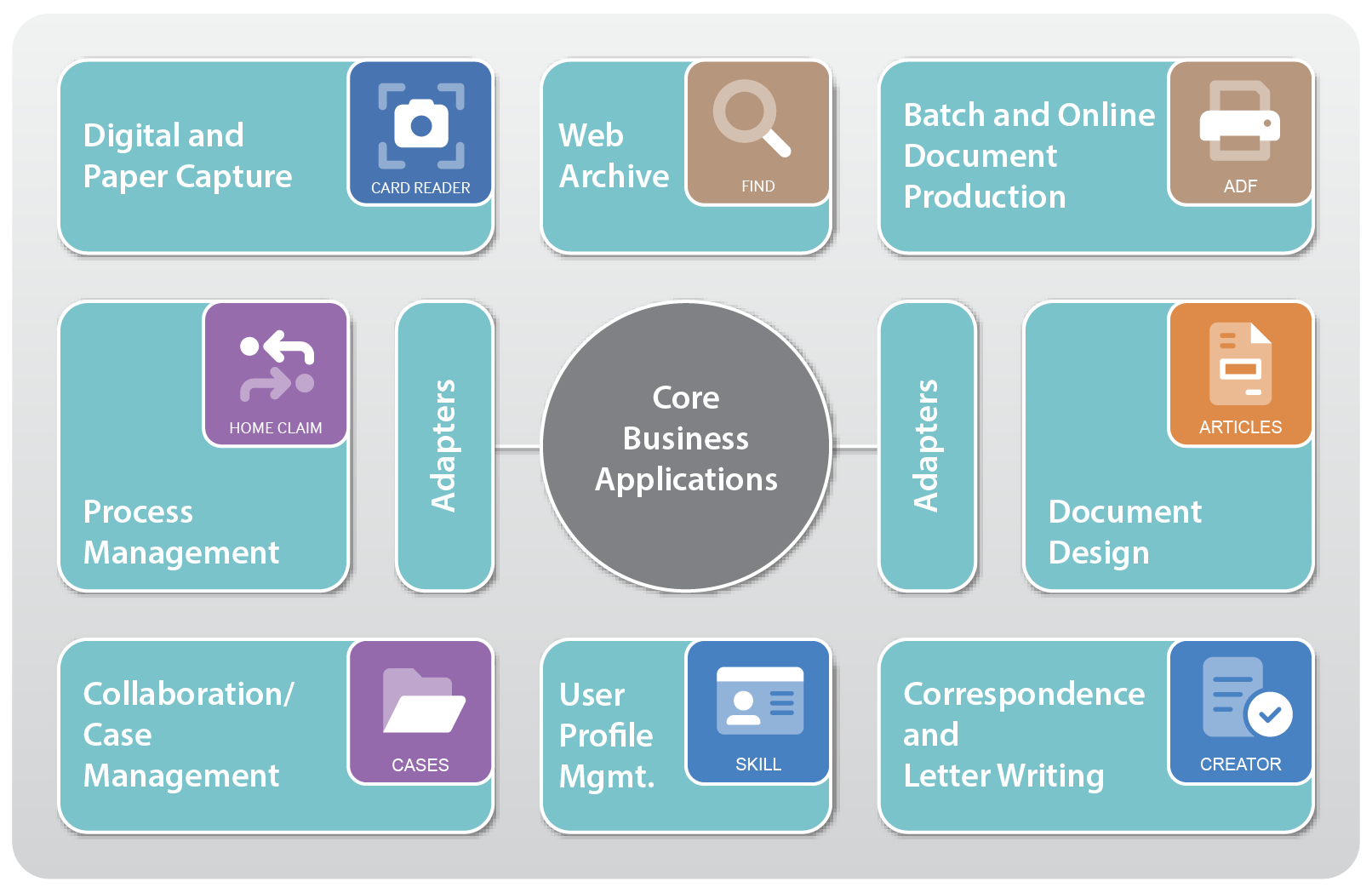

Papyrus Digital Business Platform

One of the major benefits of the Papyrus platform is its ability to flexibly interface with any software via loose coupling and configuration without hard-coding. This allowed for seamless integration with the UNObank's cloud banking platform Mambu and the rest of its AI-first, all cloud, full stack digital bank infrastructure.The Papyrus platform itself runs on the UNObank's cloud infrastructure, providing unlimited scalability and supporting the bank in streamlining its customer communication processes and delivering the best customer experience.

The solution empowers business users to work with the system instead of relying solely on IT, which further improves the efficiency of the Unobank's customer communications, allowing digital team to focus on its core competencies of delivering innovative, customer-focused banking products, rather than dealing with high levels of complexity.

Business users work with re-usable building blocks and WYSIWYG, drag & drop GUIs, and when there is a new type of communication to create, they never need to start from scratch. With a direct access to reusable building blocks and templates, they can quickly choose components they need and assemble new communication elements - all with the same tool and the same team.

The solution caters to all communication requirements: customer statements, loan agreements, advices, interest certificates, annual statements, etc., covering all output - from traditional print to modern e-delivery- within a single template. This eliminates the need for time-consuming designs and complicated sign-off procedures per delivery channel, ensuring optimal customer experience on each channel.

By choosing an established product like Papyrus, UNObank can confidently pursue its high growth plans and shape the future of banking in ASEAN.