Cashless into the Future

Leading provider of electronic, cashless payment systems relies on high automation with Papyrus Software

Business Goals

- Highest possible automation through best-in-class recognition technologies

- Flexibility in ergonomic post-processing steps

- Transparent traceability, monitoring and evaluation (e.g. who changed/edited what, when)

- PCI-DSS compatibility

- Cost reduction

- Increase in customer satisfaction through fast service

- Quality improvement and more efficient processing

Functional Requirements

- Classification/assignment of documents and processes to organizational units

- Effective transaction processing with direct inclusion of documents Role and authorization concept with complete access control

- Audit-proof archiving of documents in common office and image formats

- Setting up of archiving periods and automatic deletion after their expiry

- High configurability of the system

- Full text and metadata archive retrieval

- Logging, traceability and reporting

Papyrus Products at VR Payment

- Papyrus WebRepository

- Papyrus Recognition Server

- Papyrus Designer Package Capture

- Papyrus Client/Capture

- Papyrus Client

- Papyrus Server/SMTP

- Papyrus Server Fax/ISDN Interface

- Papyrus Server/PDF-In

Snapshot

- Organization: VR Payment

- Business Challenge: FAX receipt automation, WfMS and archive migration

- Goals: Maximum of automation and business process digitization

- Integration: File, ISDN, MAPI, SMTP

- Solution: Papyrus Intelligent Capture, Papyrus BPM & ACM, Papyrus WebArchive

The Company

VR Payment is one of the leading providers of electronic and cashless payment systems in Germany. As a service provider for the Volksbanken Raiffeisenbanken cooperative financial group, the company is responsible for cashless transactions for more than 1,100 member banks and a large number of trading companies, covering the entire spectrum - from card acceptance and processing to terminals and network operation to card blocking.

The Challenge

VR Payment receives all requests - credit card applications, notices of termination, terminal orders, etc. - as a mixture of forms and unstructured documents via fax or e-mail. Upon arrival, the incoming documents have to be instantly recognized, classified and extracted, and data and documents forwarded to applicable target systems for processing of +20 different business cases and the subsequent archival. The required turnaround time for fully automated processing (from receipt to export) is less than 3 minutes, and the required automation for machine-filled forms higher than 85 percent.

At VR Payment the company's existing FAX solution had to be replaced and in the next step all incoming mail standardized, so it can be processed and forwarded to corresponding departments and persons as quickly as possible. In addition, special requirements with regard to data security, system availability, processing time and transparency had to be taken care of in order to meet the highest security level of processing according to the requirements of PCI-DSS (Payment Card Industry Data Security Standard).

The Solution

As so often, it turned out that flexibility is one of the most important qualities. With the end-of-life (EOL) deadline looming for the fax solution in place, time was limited from the start. In spite of this, the project team managed to successfully extend the scope of the solution and not only automate the incoming fax credit card applications, complaints, cancellations, blocking, credit rating changes, etc., but also replace the company-internal Worklow Management System and OpenText archive in the next step. Only in a migration phase, 23 million documents (TIFFs, PDFs, PNGs, etc.) were migrated to Papyrus with automatic creation of business cases and assignment of case-related documents. The resulting system covers multiple processes and can be further extended at any time to reflect new business scenarios.

Highest possible automation through best recognition technologies

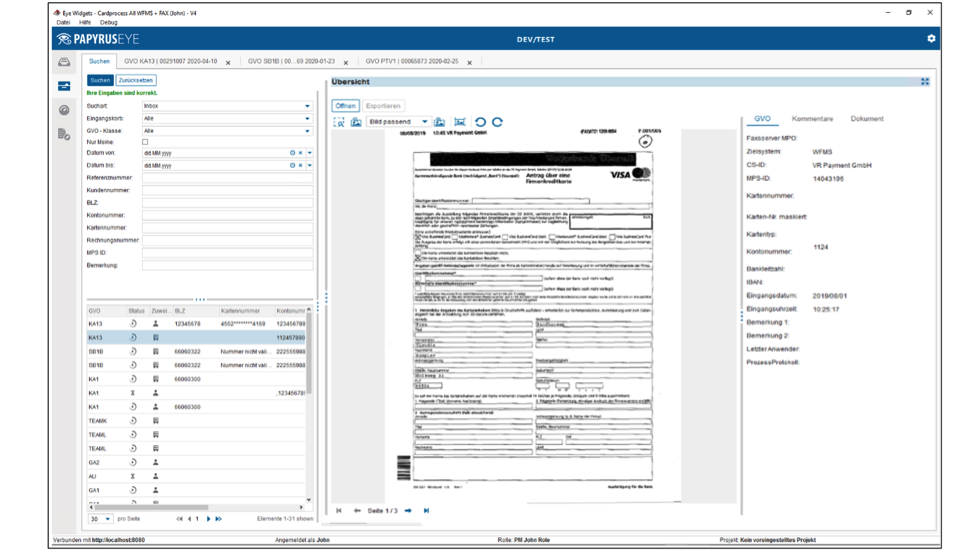

The new solution imports approximately 2,600 incoming faxes a day, classifies documents using barcodes and keywords, and reads process data instantly out utilizing different extraction definitions. Business cases are automatically recognized, and documents and metadata forwarded to the new Case Management system and Helpline Transfer database. In the event that machine classification or extraction is not possible, documents are automatically forwarded for fast manual classification and completion in a special intuitive post-processing workplace.

Additional functionalities, such as fax dispatch from the existing letter-writing system, as well as Mail2FAX and FAX2Mail functionalities are implemented as a part of the new solution. Incoming faxes are sent to appropriate mailboxes via mapping between personal virtual fax numbers and e-mail addresses, and outgoing faxes provided with a cover sheet with email metadata, and sent out with e-mail body and attachments.

Process-oriented way of working to increase efficiency

Each incoming document represents a business case that is routed to Papyrus Adaptive Case Management (ACM) for inspection, processing and secure archiving in one of Papyrus WebArchive's repository nodes.

The 25 archive nodes of the distributed archive are based on the most important VR payment scenarios - credit card application, credit card cancellation, etc. - and serve as a repository for all related business transactions. The size of each individual node is kept within limits for fast full backup and high-performance search, allowing users to search by a combination of criteria, such as reference number, business case, bank routing number, etc., and receive processing data in a split second.

Business transactions and documents can be exported from the system, deleted and sent for external processing, and documents and data directly imported into the archive via multi-level metadata evaluations and automatic document distribution to appropriate archive nodes.

Legally compliant storage & archiving

Due to the processing of credit card data, special consideration was given to PCI-DSS regulations, in particular to logging of user events (LogOn/LogOff, administrative password change, enforcement of password policies, user blocking, etc.), as well as data security, including high-level encryption and fully controlled and logged access to PCI-DSS relevant data such as account number, bank code, credit card number, etc.

The system can be flexibly configured for legally required deadlines with automated document deletion upon expiration, and provides transparent traceability, monitoring and evaluation (who changed/edited what, when). Business cases to be deleted are moved to a 'deletion depot', listed and after the final approval by business departments disposed of in nightly jobs. A strict role and authorization concept with a full access control permits employees to search and view only those business transactions for which they are explicitly authorized. The high availability of the system is implemented and guaranteed by a StandBy/FailOver solution architecture and servers that can automatically take over the application in case of failure.

Last but not least, the same digitalization platform can be used in many other VR Payment business scenarios to further streamline and digitize business communications and processes in support of company's competitiveness.

The Value

- High inbound mail automation

- Frictionless processing - From Incoming Mail Automation to Workflow & Case Management to Archive without system breaks

- Increase in customer satisfaction through fast service

- Highest security level according to PCI-DSS (Payment Card Industry Data Security Standard)

- Flexibility, Efficiency, Transparency