Transforming Customer Services with a modern, scalable image and workflow system

Business Results

- Deliver customer needs through cost efficient and scalable operating model

- Moved from mainframe supported system to server based

- Combining two existing image and workflow systems (brand specific) into one platform

- Migrated over 20,000,000 existing images

- Provided a foundation for online client servicing

- Bespoke solution to meet specific business requirements

Functional Requirements

- A more modern image and workflow system which can support business growth

- Route work to the right team at the right time

- Depository for all documentation and correspondence to and from policy holders

- View and manage work in teams and reporting to help plan each day

- Scalable solution

Papyrus Products at Utmost Life & Pensions

- Papyrus Business Designer

- Papyrus DocEXEC

- Papyrus WebRepository

- Papyrus WebArchive

- Papyrus TypeManager

- Papyrus Adapter/LDAP

- Papyrus Client

Snapshot

- Organization: Utmost Life & Pensions

- Business Challenge: Legacy image and workflow systems for different brands supported on mainframe

- Goals: Modern and cost efficient image and workflow system to support business growth

- Integration: Papyrus integrates seamlessly though TypeManagers and LDAP Adapters

- Solution: Adaptive Case Management, WebArchive

The Company

Utmost Life and Pensions is a UK life and pensions company which has been built over a number of heritage businesses that have been merged and amalgamated since 1911. These heritage businesses include Reliance Life that was acquired in 2018 and Equitable Life that was transferred to the Utmost Group in 2020. Utmost Life and Pensions has 380,000 customers, with £7bn of assets. They are also part of the wider Utmost Group Ltd, a growing specialist life assurance company currently managing £37bn assets under administration with over 500,000 customers.

The Challenge

With multiple legacy systems that had been in place for up to 30 years, Utmost Life and Pensions had the need to transform the customer service process, to be able to provide a consistently high quality customer experience whilst driving down the unit costs. In addition, Utmost Life and Pensions needed an operating model that was scalable which would enable them to acquire new books of business cost efficiently and effectively. To do this they needed a new, modern image and workflow system that could support business growth and be the foundation for online self-service which was a key element of their transformation roadmap. There was also the requirement to migrate 20 million documents from the legacy system into the new solution.

The Solution

In less than 6 months from deciding to partner with Papyrus, the new image and workflow system was launched. Papyrus delivered a bespoke solution to meet the specific requirement of the business that could adapt and scale to future demands and growth.

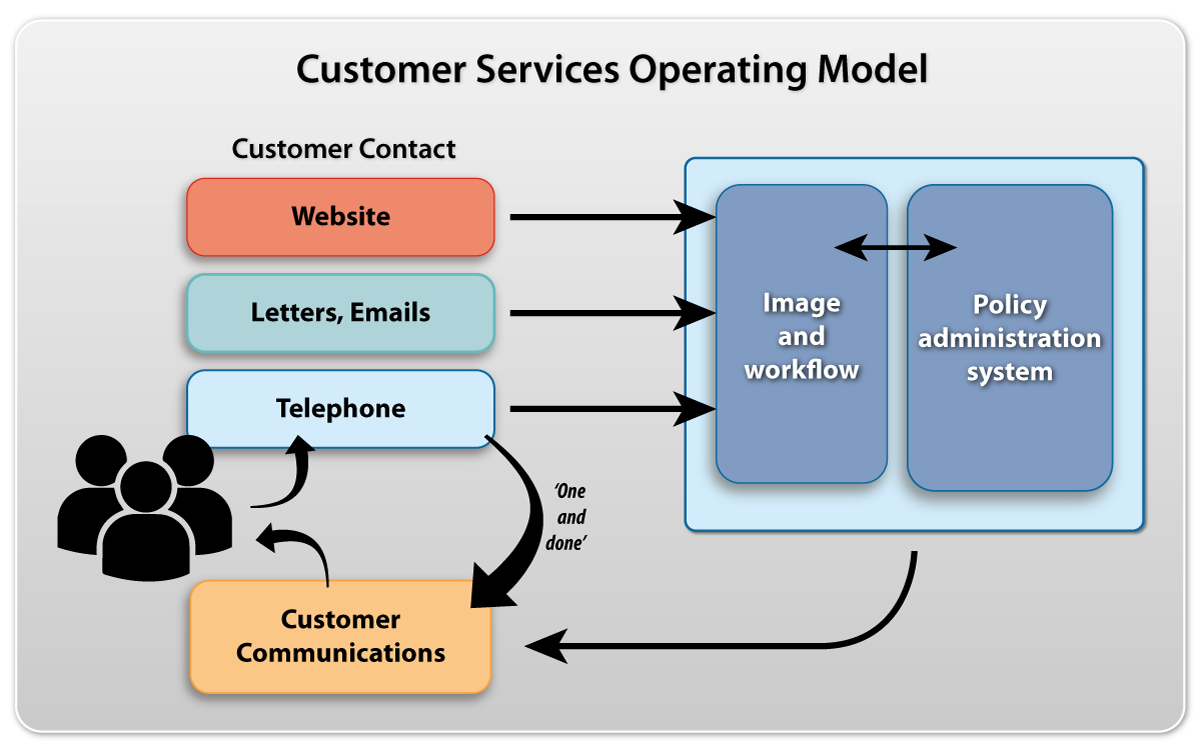

Customer Service Operating Model

Policyholders contact customer services through 3 channels: via company website, in writing by letter or email, or by telephone. Written requests, email contacts and any calls that cannot be answered on the initial call are placed into the image and workflow system, which holds all electronic correspondence. All new requests for information are routed to the correct customer service team for processing.

The teams use image and workflow and the policy administration systems to view the request, process the case, update the policy records if necessary and send a response out to the policyholder. These responses are sent by letter or by email and a copy is held in the image and workflow system.

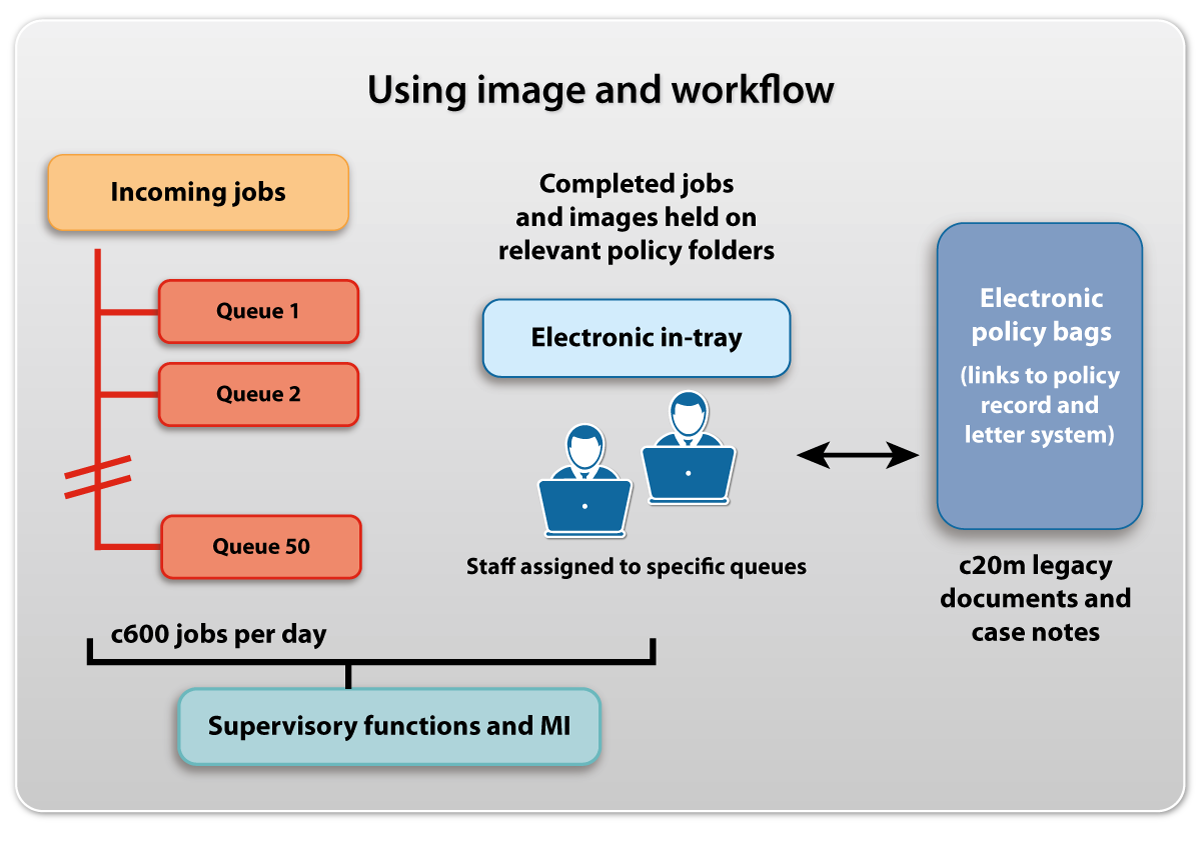

Using Image and Workflow

The new image and workflow system receives incoming jobs in the form of an XML file with some associated meta data alongside the scanned image/document. The job is then classified via a lookup using the meta data provided and interrogating the customer policy administration system which tells image and workflow where to route the job to the correct work queue or team.

Papyrus business users can design, create, modify and manage business rules and adaptive processes, and freely interact with process artefacts to dynamically change content, processes and rules at the process execution time – all to achieve the optimal customer experience and business outcomes.

It is also a depository for all documentation and correspondence to and from the policyholders. This is currently 20 million documents and growing every day.